It’s impossible to research the subject of buying a home without coming across a headline declaring that the fall in home affordability is a crisis. However, when we add context to the most recent affordability statistics, we soon realize that, though homes are less affordable than they have been over the last few years, they are more affordable than they historically have been.

Black Knight, a premier provider of data and analytics for the mortgage industry, just released their latest Monthly Mortgage Monitor which includes a new analysis of the affordability situation. Here’s what the report reveals:

“The monthly payment required to purchase the average priced home with a 20% down 30-year fixed rate mortgage increased by nearly 20% (+$210) over the first nine months of 2021, . . . It now requires 21.6% of the median household income to make the monthly mortgage payment on the average home purchase, the least affordable housing has been since 30-year rates rose to nearly 5% back in late 2018.”

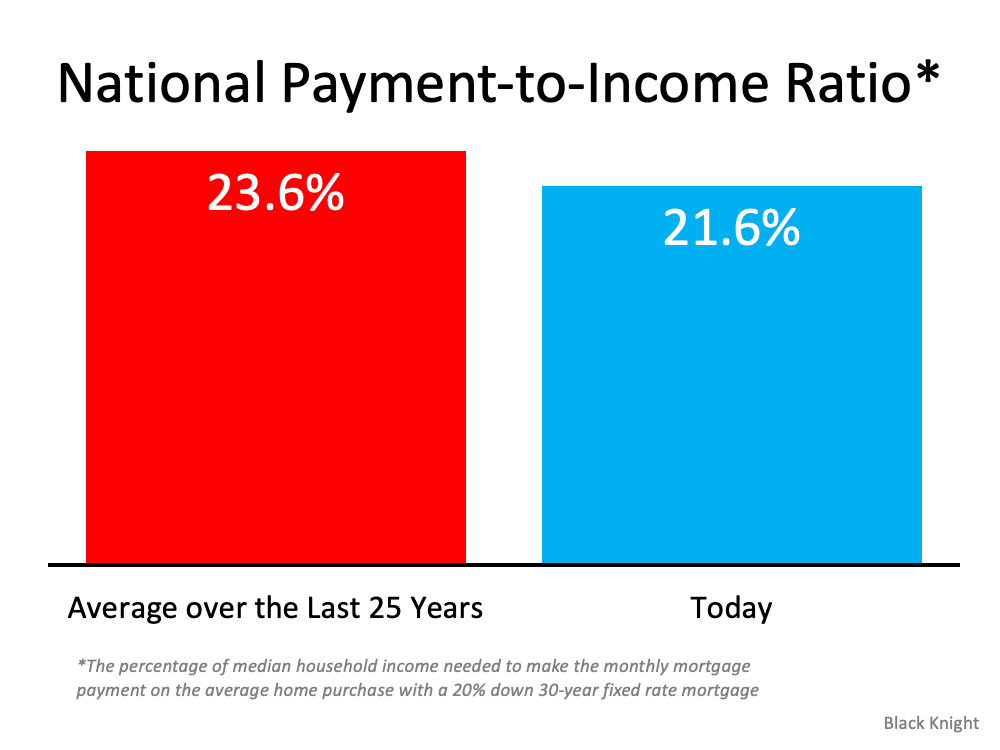

Basically, the report shows that homes are less affordable today than at any other time in the last three years. However, in a previous report earlier this year, Black Knight calculated that the percentage of the median household income to make the monthly mortgage payment on the average home purchase over the last 25 years was 23.6% (see graph below): Today’s payment-to-income ratio is more affordable than the average over the last 25 years. Given that context, we can see that American households still have the same ability to be homeowners as their parents did 20 years ago.

Today’s payment-to-income ratio is more affordable than the average over the last 25 years. Given that context, we can see that American households still have the same ability to be homeowners as their parents did 20 years ago.

This confirms the recent analysis of ATTOM Data resources where Todd Teta, Chief Product and Technology Officer, explains:

“The typical median-priced home around the U.S. remains affordable to workers earning an average wage, despite prices that keep going through the roof. Super-low interests and rising pay continue to be the main reasons why.”

Bottom Line

It’s true that it’s less affordable to buy a home today than it has been the last few years. However, it’s more affordable to buy today than the average over the last 25 years. In other words, homes are less affordable, but they’re not unaffordable. That’s an important distinction.

Hi, I am Chrysti. I am a Fair Oaks based REALTOR® and Real Estate Advisor who believes real estate works best when it feels human, calm, and supported. If you like a big sister energy kind of guide, you and I will get along just fine.

I have lived in the Sacramento and Placer foothill communities for more than three decades, and I care deeply about the people and stories here. I created I Love Fair Oaks because this town has a heartbeat, and I wanted a place to celebrate it. That work spills naturally into real estate because helping people move through life with clarity and confidence is what I love most.

My background includes real estate, mortgages, title, photography, design, and marketing. All of that helps me protect my clients and make the process feel as smooth as possible. When things get confusing, I explain. When things get stressful, I steady the room. When you need someone in your corner, I am right there with you.

I serve Fair Oaks, Orangevale, Carmichael, Gold River, Folsom, Granite Bay, Roseville, Rocklin, and the foothill communities that surround them. If you are planning a move or exploring what is next, I am here to help you find your way.

Contact916 320 2663c@chrystitovani.comCA DRE 01118449eXp Realty of California

![A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC]](https://chrystitovani.com/wp-content/uploads/2022/09/20220916-KCM-Share-549x300-1.png)

![A Crucial First Step: Mortgage Pre-Approval [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/09/15085140/20220916-KCM-Share-549x300.png)

There are plenty of good reasons you might be ready to move. No matter

There are plenty of good reasons you might be ready to move. No matter

To sell your home this spring, it may need more preparation than it would have a year or two ago. Today’s housing market has a different feel. There are more homes for sale than there were at this time last year, but

To sell your home this spring, it may need more preparation than it would have a year or two ago. Today’s housing market has a different feel. There are more homes for sale than there were at this time last year, but ![Tips To Reach Your Homebuying Goals in 2023 [INFOGRAPHIC]](https://chrystitovani.com/wp-content/uploads/2023/01/Tips-To-Reach-Your-Homebuying-Goals-in-2023-KCM-Share.png)

![Tips To Reach Your Homebuying Goals in 2023 [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/wp-content/uploads/2023/01/05130002/Tips-To-Reach-Your-Homebuying-Goals-in-2023-KCM-Share.png)

![Tips To Reach Your Homebuying Goals in 2023 [INFOGRAPHIC] | Keeping Current Matters](https://www.keepingcurrentmatters.com/wp-content/uploads/2023/01/Tips-To-Reach-Your-Homebuying-Goals-in-2023-NM.jpg)

If you’re following along with the news today, you’ve likely heard about rising inflation. You’re also likely feeling the impact in your day-to-day life as prices go up for gas, groceries, and more. These rising consumer costs can put a pinch on your wallet and make you re-evaluate any big purchases you have planned to […]

If you’re following along with the news today, you’ve likely heard about rising inflation. You’re also likely feeling the impact in your day-to-day life as prices go up for gas, groceries, and more. These rising consumer costs can put a pinch on your wallet and make you re-evaluate any big purchases you have planned to […]