If you’re planning to buy a home, it’s critical to understand the relationship between mortgage rates and your purchasing power. Purchasing power is the amount of home you can afford to buy that’s within your financial reach. Mortgage rates directly impact the monthly payment you’ll have on the home you purchase. So, when rates rise, so does the monthly payment you’re able to lock in on your home loan. In a rising-rate environment like we’re in today, that could limit your future purchasing power.

Today, the average 30-year fixed mortgage rate is above 5%, and in the near term, experts say that’ll likely go up in the months ahead. You have the opportunity to get ahead of that increase if you buy now before that impacts your purchasing power.

Mortgage Rates Play a Large Role in Your Home Search

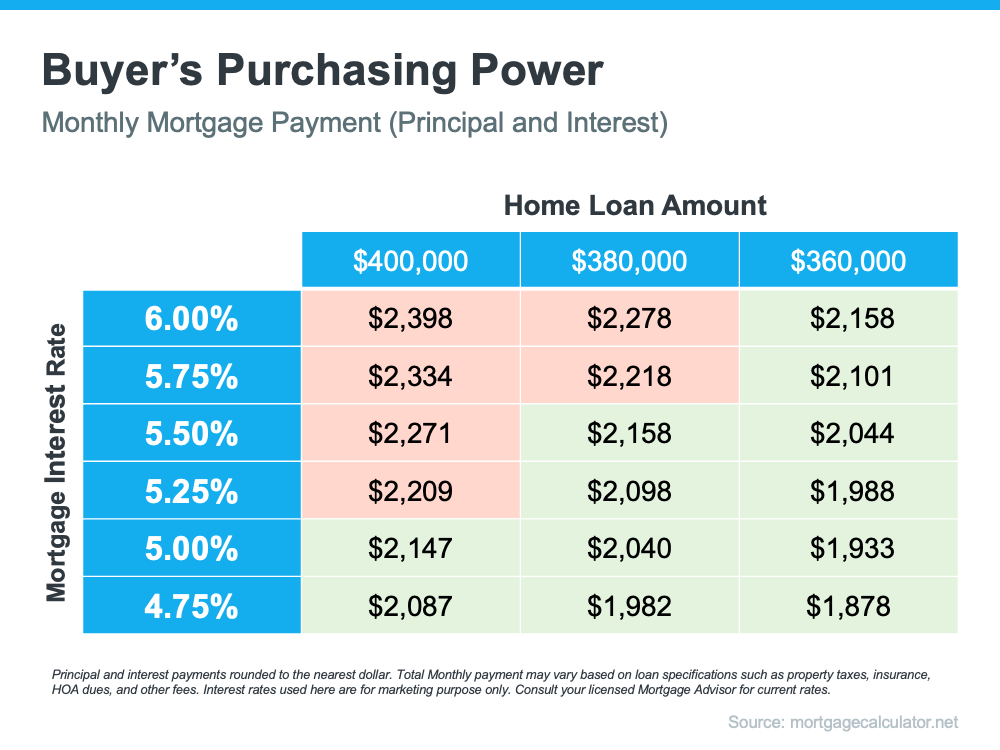

The chart below can help you understand the general relationship between mortgage rates and a typical monthly mortgage payment within a range of loan amounts. Let’s say your budget allows for a monthly mortgage payment in the $2,100-$2,200 range. The green in the chart indicates a payment within that range, while the red is a payment that exceeds it (see chart below):

As the chart shows, you’re more likely to exceed your target payment range as mortgage rates increase unless you pursue a lower home loan amount. If you’re ready to buy a home, use this as your motivation to purchase now so you can get ahead of rising rates before you have to make the decision to decrease what you borrow in order to stay comfortably within your budget.

Work with Trusted Advisors To Know Your Budget and Make a Plan

It’s critical to keep your budget top of mind as you’re searching for a home. Danielle Hale, Chief Economist at realtor.com, puts it best, advising that buyers should:

“Get preapproved with where rates are today, but also consider what would happen if rates were to go up, say another quarter of a point, . . . Know what that would do to your monthly costs and how comfortable you are with that, so that if rates do move higher, you already know how you need to adjust in response.”

No matter what, the best strategy is to work with your real estate advisor and a trusted lender to create a plan that takes rising mortgage rates into consideration. Together, you can look at your budget based on where rates are today and craft a strategy so you’re ready to adjust as rates change.

Bottom Line

Even small increases in mortgage rates can impact your purchasing power. If you’re in the process of buying a home, it’s more important than ever to have a strong plan. Let’s connect so you have a trusted real estate advisor and a lender on your side who can help you strategize to achieve your dream of homeownership this season.

Hi, I am Chrysti. I am a Fair Oaks based REALTOR® and Real Estate Advisor who believes real estate works best when it feels human, calm, and supported. If you like a big sister energy kind of guide, you and I will get along just fine.

I have lived in the Sacramento and Placer foothill communities for more than three decades, and I care deeply about the people and stories here. I created I Love Fair Oaks because this town has a heartbeat, and I wanted a place to celebrate it. That work spills naturally into real estate because helping people move through life with clarity and confidence is what I love most.

My background includes real estate, mortgages, title, photography, design, and marketing. All of that helps me protect my clients and make the process feel as smooth as possible. When things get confusing, I explain. When things get stressful, I steady the room. When you need someone in your corner, I am right there with you.

I serve Fair Oaks, Orangevale, Carmichael, Gold River, Folsom, Granite Bay, Roseville, Rocklin, and the foothill communities that surround them. If you are planning a move or exploring what is next, I am here to help you find your way.

Contact916 320 2663c@chrystitovani.comCA DRE 01118449eXp Realty of California

Over the past two years, the substantial imbalance of low housing supply and high buyer demand pushed home sales and buyer competition to new heights. But this year, things are shifting as supply and demand reach an inflection point. The graph below helps tell the story of just how different things are today. This year, […]

Over the past two years, the substantial imbalance of low housing supply and high buyer demand pushed home sales and buyer competition to new heights. But this year, things are shifting as supply and demand reach an inflection point. The graph below helps tell the story of just how different things are today. This year, […]

The real estate market is on just about everyone’s mind these days. That’s because the unsustainable market of the past two years is behind us, and the difference is being felt. The question now is, just how financially strong are homeowners throughout the country? Mortgage debt grew beyond 10 trillion dollars over the past year, […]

The real estate market is on just about everyone’s mind these days. That’s because the unsustainable market of the past two years is behind us, and the difference is being felt. The question now is, just how financially strong are homeowners throughout the country? Mortgage debt grew beyond 10 trillion dollars over the past year, […]

Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and home prices so you can make your […]

Now that the end of 2022 is within sight, you may be wondering what’s going to happen in the housing market next year and what that may mean if you’re thinking about buying a home. Here’s a look at the latest expert insights on both mortgage rates and home prices so you can make your […]![Home Prices Up 6.49% Across the Country! [INFOGRAPHIC]](https://chrystitovani.com/wp-content/uploads/2018/09/20180907-STM-ENG-768x1175.jpg)

It’s economy 101 – when supply is low and demand is high, prices naturally rise. That’s what’s happening in today’s housing market. Home prices are appreciating at near-historic rates, and that’s creating some challenges when it comes to home appraisals. In recent months, it’s become increasingly common for an appraisal to come in below the […]

It’s economy 101 – when supply is low and demand is high, prices naturally rise. That’s what’s happening in today’s housing market. Home prices are appreciating at near-historic rates, and that’s creating some challenges when it comes to home appraisals. In recent months, it’s become increasingly common for an appraisal to come in below the […]

Homeownership has long been considered the American Dream, and it’s one every American should feel confident and powerful pursuing. But owning a home is also a deeply personal dream. Our home provides us with safety and security, and it’s a place where we can grow and flourish. Today, we remember the legacy of Dr. Martin Luther King, […]

Homeownership has long been considered the American Dream, and it’s one every American should feel confident and powerful pursuing. But owning a home is also a deeply personal dream. Our home provides us with safety and security, and it’s a place where we can grow and flourish. Today, we remember the legacy of Dr. Martin Luther King, […]